Important points before investing in a Solar Company IPO

More solar companies are coming up with an IPO to accelerate their growth.

The market for solar PV technology is driven by the shift in the focus from fossil fuels to clean energy solutions to reduce carbon emissions.

Climate change is a concern of many countries around the world.

To mitigate this, the major economies around the world are supporting clean energy options such as Solar energy through incentives, reducing the solar PV manufacturing cost.

The price of solar modules and the components used in the system have reduced considerably in the last decade, due to the improvement in the technology which is owing to consistent investment in research and development.

Now you see the focus is shifting from polycrystalline solar panels to monocrystalline ones.

Due to their high efficiencies, lower heat losses, and better performances under shade.

Now we see the latest technology solar panels such as Mono-PERC, TOPCON with n-type, HJT, and bifacial solar panels. Jinko Solar reported the highest efficiency of 26.89% with its 182 mm monocrystalline TOPCON cell.

1. The demand and supply gap of Solar Energy in India

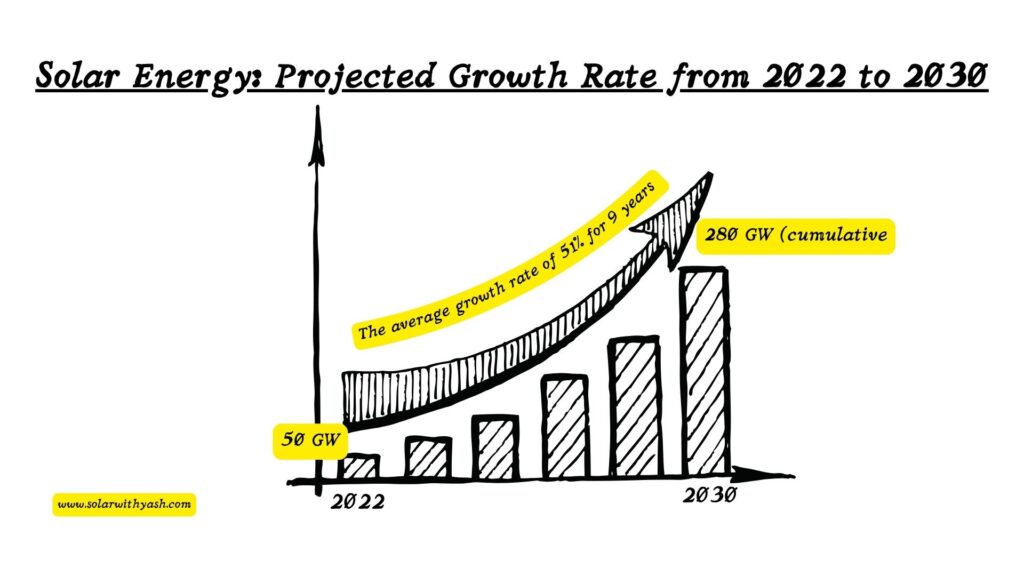

Considering the solar energy target of 280 GW of the installed base by 2030.

It is 50 GW as of January 2022.

There is a space of another 230 GW in the next 9 years.

If implemented, it would be a growth of (280GW – 50GW)/50 GW x100%

= 460 % growth in the next 9 years or

The average growth would be 460%/9 = 51.1% per year.

This could be an immense growth potential if implemented properly.

With the support of the Government’s PLI (policy-linked incentives), many players are coming up with robust expansion plans to meet these targets.

(a) Criteria for qualifying for PLI scheme

However, to qualify for the PLI scheme by the government, the manufacturers have to set a facility of a minimum of 1000 MW capacity with the following minimum solar module parameters:

(i) The minimum module efficiency of 19.50% with a Temperature coefficient of power better than -0.30%/°C

Or

(ii) The minimum module efficiency of 20% with a Temperature coefficient of power better than -0.40%/°C

(b) Top Indian solar companies

- Vikram

- Waaree

- Tata Power

- Rayzon solar

- CIL

- Renew Power

- Solex energy

- Adani Solar

- Premier Energies

- Goldi Solar

- Emmvee

- Saatvik Green

- ACME Eco

- Avaada Ventures

- Megha Engineering

2. What is an IPO?

It is a process of offering shares of a private company to the public.

This process makes the private company, a public company.

This is an important step for the company to raise big capital from the public or the market.

This gives the company the ability to grow at a much faster rate.

(a) IPO relevance for Solar PV companies in India:

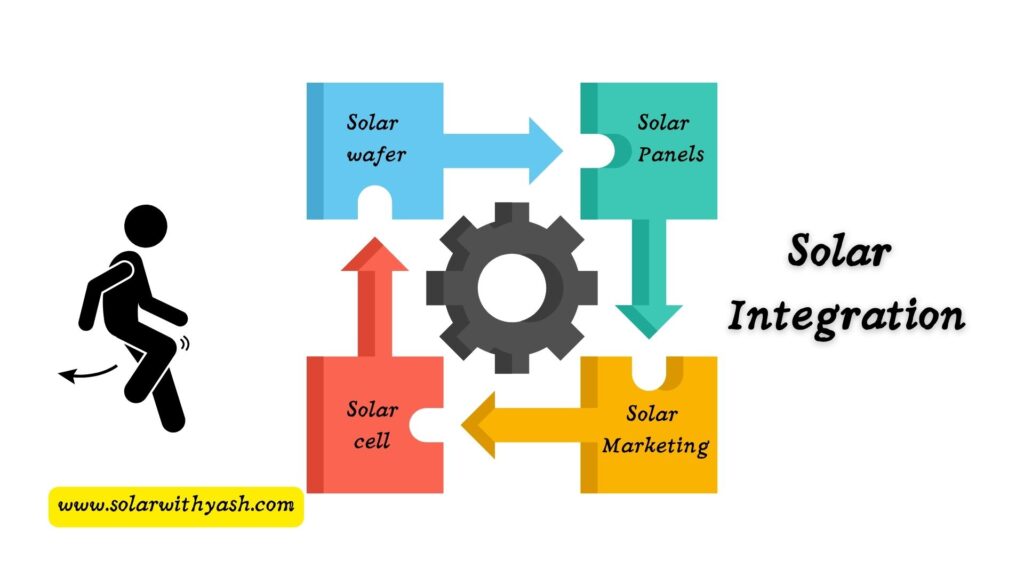

Most of the Indian solar companies do not have manufacturing units for polysilicon ingots and wafers.

These are the key raw materials for making the solar panels and they constitute over 50% to 60% of the total cost of the solar panels.

While the Chinese solar companies are largely backward integrated with in-house ingot and wafer manufacturing facilities.

Hence, they achieve economies of scale and command the solar panel price in the world.

Integrated solar panel manufacturing requires a high upfront investment to achieve economies of scale.

It is very difficult for the small player to remain price competitive in the long run.

Sooner or later, it has to expand to set up a backwardly integrated system.

Example

If a company is raising funds for setting up a plant such as a 1000 MW or 2000 MW integrated solar cell and solar module plant.

This is a type of backward-integration solar cell manufacturing for making solar panels.

So that the company can achieve economies of scale.

It is a good thing if an Indian company is planning to raise money through an IPO for setting up a plant for wafer manufacturing backward.

This backward integration will help the company to achieve economies of scale and hence will have better profit margins.

The IPO prospectus shows the breakdown of the raised amount to be invested by the company under the following heads.

A breakdown of the cost such as:

- Land and site development

- Building and civil work

- Plant and machinery

- And other miscellaneous expenses

3. Know the Solar Company

The first step investors need to know is the company’s objective behind raising an IPO.

Does the company’s objective resonate with its current business?

Is the company raising money to address its and the industry’s most important problem?

If things are aligned then the company’s raising money is justified.

(a) Management of the company

Sound management can run the company’s operations effectively and save the company in tough times.

Therefore, the investors need to know the quality of the management through certain parameters such as their education, experience in terms of handling solar PV projects, and their stability in the management.

(Ability to build new manufacturing plants and production lines cost-effectively. The management has to be experienced and qualified. There could be delays in taking approvals such as NOC for the building plan, approval for construction, consent to establish, and others that could affect the company’s profitability. Renewal of permits and licenses).

These parameters show the management’s soundness though not exhaustive.

Solar PV technology is one of the engineering branches. So, the management should consist of qualified engineers.

Are the management key people stable or shifting frequenting?

Frequent shift in the management shows instability in the company’s operations.

(b) Major events and milestones

This shows the growth of the company and also its quality manufacturing.

This shows the growth of the company and also its quality manufacturing.

- Is the company coming up with new technology in the solar sector or not?

- Is its production capacity increasing gradually?

- Is the company expanding in other states of the country?

The company has the potential to expand further through an IPO.

If the company is growing steadily there is much likelihood that through an IPO the growth drivers will also remain consistent.

Also awards and accreditation in the public.

The work the company is doing is being well received by the public and the government or not?

The work you are doing should be accepted by the people otherwise the company is not growing or the company is not making what customers want.

4. Analyze the IPO Price

The price of the share reflects the company’s valuation.

Assuming, a company is coming up with an IPO through the issuance of 10,00,000 shares in a price band of Rs. 50-Rs.60.

Which gives the valuation as Rs. 5 crores to 6 crores (Rs. 50 x 10,00,000 to Rs. 60 x 10,00,000).

The investor needs to verify this.

One technique for finding the present value of the company is the Discounted Cash Flow technique.

The valuers discount the expected future cash flows to the present value and many aspects while finding the value of the company.

This is very much technical.

However, I give you a simple yardstick to know the right price for the company.

Assuming, a similar company of similar capacity is already listed on the stock exchange and trading at price X.

Then the company coming with a fresh IPO should have a price band close to this price X. If you see a higher pricing then it can be overinflated.

5. Know the Financial Performance of the solar company

It is important to understand the company’s finances before investing in it.

The key financial metrics that help investors to understand its financial health are:

(a) Income from Operations:

The investors need to analyze the income from the company’s operations (in this case selling solar panels) in the last 5 years.

Whether it is increasing, decreasing, constant, or erratic.

If the income is increasing gradually and steadily, it is a sign of strong growth.

(b) D/E Ratio:

It is the total debt to the total equity of the company. Ideally, the D/E ratio is to be 1:1. But the capital-intensive companies having D/E > 1 are normal. For investors looking to invest in solar companies, the D/E ratio equal to or less than 2 is fairly normal and acceptable.

(c) ROCE

The return on the capital employed is the ratio of profit before interest and taxes to the total capital employed. The capital employed is the sum of net worth, total debt, and tax liability. A ROCE close to 15% is considered good.

(d) PAT

It is the profit after taxes. Look for the rising trend in the PAT over the last 5 years.

Excluding the period of COVID-19 when everything was shut down. Taking values in that period would not be a realistic assumption.

6. Litigations and liabilities

Before investing in a solar company, it is important to know the litigations and liabilities of the promotors as it could affect the decision-making and the company’s operations.

The Promotors may get involved in any legal proceedings, which may lead to penalties and can affect the decision-making of the company.

You can know about this in the summary of the outstanding litigations and the material developments section of the prospectus. It shows the litigations by and against the company, directors, and its subsidiaries.

The litigation could involve any or more of these legal processes:

- Criminal proceedings

- Tax proceedings

- Regulatory proceedings

- Disciplinary action by SEBI

- Material civil proceedings

It is also important to know the contingent liabilities and commitment by the company. These liabilities may affect the management’s time, attention, and financial resources.

This could also affect the reputation and the profitability of the company.

7. Variation in Raw Material prices

The silicon wafers and the solar cells are the main raw materials for solar PV technology.

Changes in their prices and other raw material prices may have adverse effects on the manufacturing of solar panels and their capacity. Most of the solar module raw material is imported from China, Taiwan, and Malaysia. Any restrictions or increases in the import duty may adversely affect the raw material prices and operations of the business.

The recent power crisis in China has curtailed its manufacturing operations which has adversely affected the solar imports. It has increased the cost of silicon wafers and cells and hence the solar projects.

Such incidents can happen again.

(a) Key raw material and their source

The primary raw material for the manufacturing of solar photovoltaic modules is Silica.

The leading countries in silicon production are:

- China (more than 2/3 of the global production)

- Russia

- Brazil

- Norway

- USA

- France

The global silicon production in the year 2021 was 8.5 million tonnes.

8. Evaluate the order book of the Company

A good order book implicit that the company has enough projects in hand to execute for its clients.

And the company will get paid for this.

Also, the investors need to analyze whether the company is having long-term or short-term contracts with its suppliers.

If the company has a short-term contract with its supplier, then upon the unavailability of the raw material the supplier may not fulfill its commitments.

In the absence of the raw material, the project will get delayed and the cost will increase.

However, the order book has further 2 types of contracts, one is short term contracts and another is long term.

9. Product Diversification

The company should have multiple products of the same category to sell to maintain the revenue stream. If income is mainly from only selling one product, then the company’s revenue is more volatile than the one having multiple products to sell.

10. Risks

(a) Risk of change in technology

The solar PV technology is an evolving technology. The solar panels which were considered efficient 5 years ago are now outdated. We are witnessing the latest solar panel technologies such as Mono-PERC, half-cut, and TOP-con which make solar panels over 23%.

But there is no guarantee these technologies remain forever.

The other technologies may evolve with time and the existing production line may not be suitable for producing the latest technology solar panels.

Therefore, the company needs to keep investing part of its income in research and development to invent new solar PV technologies.

(b) Insurance coverage risk

Solar PV is a capital-intensive industry, requiring heavy investment. Any damage to the equipment due to unforeseeable circumstances may put the production line suspended.

And the company may not be able to re-purchase the equipment again due to its heavy cost.

Therefore, the company’s assets must be covered under insurance. The underinsurance of the assets is a risk for the company.

(c) Pandemic Risk

The outbreak of any contagious disease like COVID-19 in the future may adversely affect the functioning of the company and procuring the of raw materials. This could delay the setting of the manufacturing facility beyond the time specified. This may increase the cost of the project.

This affects both the exports and imports of raw materials.

The other risks are political risk, inflation, and exchange rate fluctuations.

11. Growth drivers

- Declining prices of modules and other components

- Fiscal and regulatory incentives of accelerated depreciation and regulatory incentives.

- Renewable Purchase Obligation (RPO targets)

- Infrastructure from the Government by developing solar parks

- Technological advancement

- Green Hydrogen

- PM KUSUM Yojna

- Solar rooftop residential incentive

- Jawahar Lal Nehru National solar mission

- Agrivoltaics

- Different Rooftop solar models (OPEX or RESCO model, CAPEX model)

12. Roadblocks

- Funding availability

- High initial cost

- Need for battery storage in the solar market

Conclusion

The solar IPO allows those who are interested in investing in renewable and clean energy.

However, the investors must act carefully and analyze the IPO prospectus carefully while making any decision.

The IPO is an ideal route for the solar company to raise capital and implement its growth plans.

Management experience and qualifications will help the company in implementing the growth strategy.

The growth strategy must be in line with the company’s operations and the management should have the ability to forecast the demand and supply and the prices of the raw material.

Disclaimer: This article is for informational purposes and the investor should not rely on this for making any financial decisions. Kindly consult a professional financial advisor before investing in a solar IPO.